Protecting the Bottom Line: Why Australian Fleet Managers Can’t Ignore ‘Diminished Value’

For a fleet manager or a small business owner, a company vehicle isn’t just a mode of transport—it’s a significant asset on the balance sheet. When that asset is involved in a collision, the immediate focus is usually on getting it back on the road.

However, once the repairs are finished, a silent financial hit remains: Diminished Value (legally known in Australia as Inherent Depreciation).

Even a perfectly repaired vehicle will fetch significantly less at lease-end or resale because of its accident history. If your fleet management strategy doesn’t account for this equity gap, your company is losing money. Here is how to protect your fleet’s market value.

The Equity Gap: Why ‘Fixed’ Doesn’t Mean ‘Full Value’

Australian common law operates on the principle of Restitutio in Integrum—the right to be restored to your pre-accident financial position.

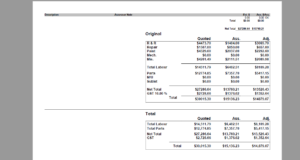

If a company car with a book value of $60,000 is involved in a major repair, its post-repair market value might drop to $48,000 due to the “stigma” of the repair record. Insurance companies will pay for the panel beating, but they won’t voluntarily write you a check for that $12,000 loss in equity. To recover that loss, you need a forensic vehicle assessor to quantify the gap.

The Fleet Manager’s Evidence Checklist

To successfully claim diminished value against an at-fault party’s insurer or in a tribunal (like NCAT or QCAT), your “Proof of Loss” must be data-driven and forensic. Ensure your fleet department gathers:

- Asset Register Records: Documentation of the vehicle’s pre-accident book value and service history.

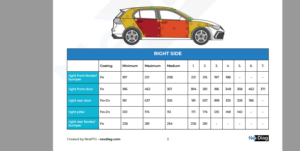

- The Full Repair Dossier: Itemised quotes and final invoices. Structural repairs or the use of non-genuine parts are key drivers of value loss.

- PPSR Disclosure Proof: A report showing the accident is now a permanent part of the vehicle’s public history, directly impacting its future resale.

- Market Comparative Analysis: Current data showing the price of “clean” vs. “accident-history” units in the secondary market.

- A Forensic Assessment Report: This is the cornerstone. An independent car assessor provides the expert testimony required to turn “estimated loss” into “recoverable debt.”

Debunking the ‘10% Cap’ Myth

A common misconception in the Australian fleet industry is that diminished value is capped at 10% of the vehicle’s value. This is a myth.

This 10% figure is often misquoted from US legal formulas (like the ’17c formula’) or manufacturing class actions. In Australian tort law, there is no arbitrary cap. If your professional vehicle assessor can prove a 20% or 25% drop in market equity through forensic analysis, that is the amount your company is entitled to pursue.

Why Commercial Fleets Need Independent Assessment

Internal insurance assessors are incentivised to minimize claim costs. They are not tasked with protecting your company’s long-term asset value.

By engaging an independent car assessor, you gain a partner who specializes in Forensic Suite Services. We provide the high-precision reports trusted by legal firms and national fleets to resolve disputes, protect lease-end residuals, and ensure that a single accident doesn’t result in a permanent write-down of your company’s capital.

The Bottom Line for Business

Every unrepaired “loss in value” is a hit to your company’s bottom line. Whether you manage five cars or five hundred, protecting the resale equity of your fleet is a fiduciary responsibility.

Don’t settle for a generic check-over. Ensure your fleet’s value is protected by the experts in forensic motor assessing.

Contact OA Motor Assessing today to discuss our specialised services for fleet managers and commercial vehicle owners.

Disclaimer: This post provides general information for business purposes and does not constitute legal advice. For specific recovery actions, we can connect you with a specialist commercial or motor vehicle lawyer.