MOTOR ASSESSING

Not-At-Fault Assessment

In a not-at-fault collision, the most powerful tool you have isn’t just an insurance policy—it’s an independent, forensic not-at-fault car accident assessment. While insurers often push for “economical” repairs and minimal payouts, our role is to define the technical truth. We provide the expert evidence required to ensure you are restored to your exact pre-accident position, protecting both your safety and your vehicle’s financial value.

Detailed Liability & Damage Reporting

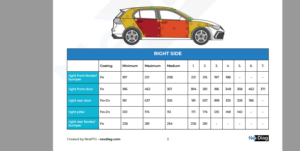

We provide independent verification of fault and impact severity, creating an indisputable paper trail that insurance adjusters cannot ignore.

OEM Standard Repair Auditing

We identify the exact manufacturer-specified parts and processes required for a safe restoration, preventing the use of “budget” or non-genuine alternatives.

Diminished Value Quantification

Even a perfectly repaired car loses resale value. We are specialists in assessing “Inherent Diminished Value,” providing the data you need to claim back the equity lost simply because the car now has an accident history.

Our Services

Why OA SERVICES

We don’t work for insurance companies. Our only allegiance is to the technical facts of your vehicle’s condition

In most cases, our professional assessment fees are fully recoverable from the at-fault party’s insurer, meaning you get elite advocacy with no out-of-pocket expense

We understand that momentum is key. Our modern diagnostic tools allow us to provide comprehensive reports faster than industry generalists, moving your claim out of “limbo” and toward a resolution.

100%

95%

100%

Flexible Service Offering

Assessments within 48 hrs

Maximise Savings

FAQ

Frequently Asked Questions

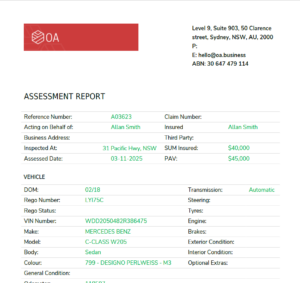

In a not-at-fault scenario, relying on the at-fault party’s insurer often leads to cost-cutting repair methods that may compromise your vehicle’s safety or resale value. OA Motor Assessing provides the independent technical authority to establish a “fair and reasonable” repair based on technical necessity, not insurer budgets. Our forensic-level assessments use advanced technology to identify every specific component and required procedure, ensuring your vehicle is restored to its true pre-accident condition without compromise.

Under Australian Common Law, the at-fault party is responsible for all reasonable costs incurred to restore your position, including professional assessment fees. OA Motor Assesing offers fixed, up-front pricing, making it easy to manage expenses and include our fee as part of your total claim recovery. Because our reports are comprehensive and built on undisputed technical data, they carry significant weight when seeking reimbursement from third-party insurers or through legal recovery channels.

When you are not at fault, you have the right to ensure your vehicle is repaired to manufacturer standards. OA Business supports this right by providing Vehicle Repair Estimates that prioritize manufacturer-standard parts and methods over the “cheapest option.” Our independent reports give you the evidence needed to justify using your preferred high-quality repairer, ensuring that your vehicle’s structural integrity and warranty—especially for complex vehicles like EVs or 4WDs—remain intact

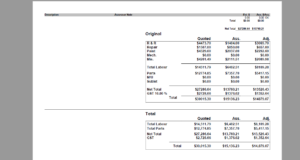

Third-party insurers often use low-ball Pre-Accident Values (PAV) to force a total loss. OA Motor Assessing specializes in Loss Assessment, rigorously calculating the true market value of your asset to prevent undervaluation. If a dispute arises, we can provide Expert Witness Reports that are court-compliant and designed to challenge unfair settlement offers. We also offer Post-Valuation assessments to help you claim for “Diminished Value”—recovering the financial equity lost now that your car has an accident history.

Yes, as the not-at-fault party in Australia, you are entitled to “Loss of Use” compensation. While OA Business focuses on the technical assessment, our fast-track reporting (including rapid Desktop Assessments) is designed to minimize your downtime. By delivering high-accuracy reports in a fraction of the industry-standard time, we accelerate the entire claims process, helping you move from “limbo” to a resolution—and out of a rental car—much faster from our network of hire car partners.

More Insights

Assisting Individual’s and Business Customers for better outcomes.

Need a partner that understands workflow speed is essential!

- Fast Turn-around

- Dedcated Account Manager

- Portal Access