MOTOR ASSESSING

Not-At-Fault Assessment

To achieve maximum recovery on third-party claims, you need more than just an estimate—you need an authoritative technical audit that insurers can’t ignore. While at-fault parties try to ‘average down’ repair costs, our role is to validate the true cost of OEM-standard restoration. We provide the forensic evidence needed to eliminate short-payments and disputes, ensuring your clients are fully indemnified and your recovery yields are maximized without the usual back-and-forth.

Expert Validation for OEM-Method Repairs

Don’t let insurers cut corners. We audit and validate that repairs meet manufacturer standards, ensuring you are paid for the correct methods and genuine parts.

Defending Your Repair Integrity

We provide independent technical reports that support your workshop’s commitment to safety and quality against insurer cost-cutting pressure.

Technical Compliance & Method Oversight

Align your estimates with factory-approved procedures through our independent auditing, protecting your liability and your profit margins.

Our Services

Why OA SERVICES

We don’t work for insurance companies. Our only allegiance is to the technical facts of your vehicle’s condition

In most cases, our professional assessment fees are fully recoverable from the at-fault party’s insurer, meaning you get elite advocacy with no out-of-pocket expense

We understand that momentum is key. Our modern diagnostic tools allow us to provide comprehensive reports faster than industry generalists, moving your claim out of “limbo” and toward a resolution.

100%

95%

100%

Flexible Service Offering

Assessments within 48 hrs

Maximise Savings

FAQ

Frequently Asked Questions

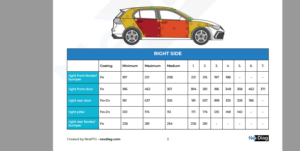

At-fault insurers often attempt to “short-pay” by substituting OEM methods with generic alternatives. Our technical audits, along with manufacturer position statements serve as expert evidence that validates the necessity of manufacturer-certified repair procedures for safety and liability reasons. By framing these methods as essential for restoration to pre-accident condition, we help you secure the maximum possible authorization for the high-standard work you actually perform

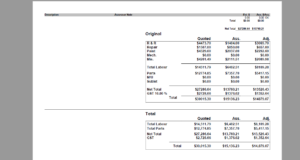

Recovery is won or lost in the details. Rather than providing a “global” estimate that insurers can easily discount, our assessments provide a granular, line-by-line forensic breakdown of the entire repair procedure. By itemizing every manufacturer-mandated step—from specific substrate preparations to necessary sensor recalibrations—we shift the focus from the “hourly rate” to the technical necessity of the work. This transparency makes it significantly harder for third-party insurers to apply arbitrary cost caps, providing you with the defensible evidence needed to justify a maximum recovery that reflects the true value of your workshop’s expertise.

We understand that cycle time is everything for workshop cash flow. We prioritize speed to ensure vehicles don’t sit in your yard waiting for a decision. Most reports are delivered within 24–48 hours of inspection. Our goal is to provide a “bulletproof” document that the at-fault insurer can’t sit on, fast-tracking the authorization so you can start the job immediately.

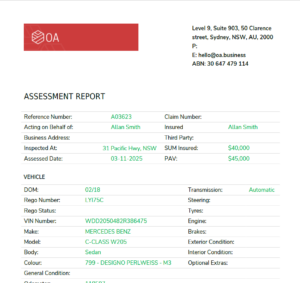

To keep a repair job in your workshop, the PAV needs to reflect the vehicle’s true market strength. Our assessors don’t just look at “book value”; we perform a deep-market analysis to justify a premium valuation. By maximizing the PAV, we widen the “repairable window,” allowing for a larger authorized repair budget and preventing the vehicle from being written off by an at-fault insurer looking for an easy exit.

For accident management firms, adding a Diminished Value assessment is key to maximizing the total claim quantum. It addresses the financial hit the vehicle takes simply by having an accident history—a loss that often goes unclaimed. By quantifying this “equity loss,” we provide the data your recovery team needs to pursue a more substantial settlement, ensuring the total recovery reflects the full economic impact of the accident.

More Insights

Assisting Individual’s and Business Customers for better outcomes.

Need a partner that understands workflow speed is essential!

- Fast Turn-around

- Dedcated Account Manager

- Portal Access