Challenging the “Cost-Containment” Narrative: A Solicitor’s Guide to Refuting Insurer-Aligned Assessments

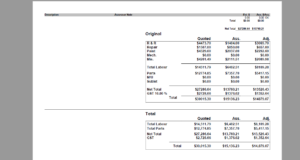

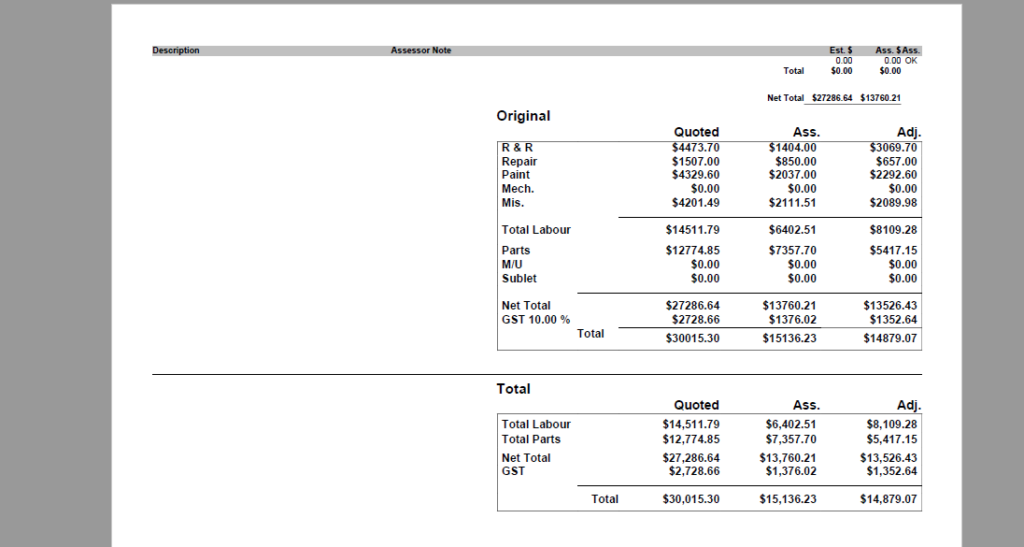

In the process of not-at-fault recovery, the “Quantum Dispute” has become increasingly sophisticated. As a solicitor or accident management professional, you’ve likely encountered a familiar obstacle: a “Fair & Reasonable” (F&R) determination from a third-party assessing firm like AAMC (Accident & Advisory Management Consultants).

Contracted by major insurers, these firms are designed to act as a barrier to full cost recovery. Their primary mandate is “cost containment”—a euphemism for reducing the payout on your client’s claim.

To secure the true cost of reinstatement, legal teams must look past the professional formatting of these reports and expose the technical and procedural flaws inherent in insurer-aligned assessing. Here is how to strategically breakdown and refute an insurer-mandated assessment.

1. The “Desktop Review” Fallacy

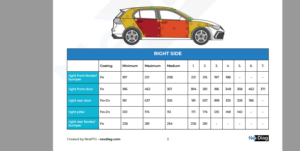

Many insurer-aligned assessments, particularly those from AAMC, are “Desktop Reviews” conducted via photos rather than physical inspections. While cost-effective for the insurer, they are technically deficient for the claimant.

The Refutation: A desktop report cannot account for hidden structural damage, compromised ADAS (Advanced Driver Assistance Systems) sensors, or internal clips and brackets that are only visible upon strip-down.

Tactical Response: Contrast their “photo-based opinion” with a physical inspection report from OA Motor Assessing. A physical report carries significantly higher evidentiary weight in court as it is based on primary observation, not digital approximation.

2. Arbitrary Labour Rate Compression

Insurers often rely on “market-average” labour rates that bear no relation to the actual specialised skills required for modern vehicle restoration. They will claim a repairer’s rate is “excessive” based on their own internal, bulk-discounted data.

The Refutation: Under tort law, a not-at-fault party is entitled to be made whole. This means the car must be repaired by a competent, manufacturer-standard shop—not the cheapest one in a 50km radius.

Tactical Response: Challenge the “Fair & Reasonable” determination by demanding the data set they used to define the “market rate.” Most insurer-aligned firms cannot produce local, specific data that justifies a rate lower than a specialist manufacturer-approved repairer.

3. OEM vs. “Alternative” Parts

One of the most common cost-cutting tactics is the suggestion of “Like Kind and Quality” (LKQ) or aftermarket parts. AAMC reports often flag OEM parts as an “unnecessary betterment.”

The Refutation: For modern vehicles, particularly those still under warranty or equipped with complex safety tech, aftermarket parts can compromise the structural integrity and resale value.

Tactical Response: Use an independent assessor to document why specific OEM components (such as high-tensile steel reinforcements or calibrated sensors) are a technical necessity for safety and manufacturer compliance, not a “betterment.”

4. Ignoring Manufacturer-Standard Procedures

Insurance-aligned assessors often “trim” the repair methodology, removing steps like pre- and post-repair diagnostic scans or specific calibration sequences.

The Refutation: If a repair method deviates from the manufacturer’s technical manual, the vehicle is not being returned to its pre-accident condition. It is being returned in a potentially unsafe state.

Tactical Response: Highlight that any “savings” suggested by the insurer-aligned report come at the cost of the vehicle’s safety certification. Solicitors can argue that the insurer’s assessment encourages a breach of duty of care by the repairer.

How OA Motor Assessing Empowers Your Litigation Strategy

For accident management companies and solicitors, a “Fair & Reasonable” report from an insurer-aligned firm is not a dead end—it is an opening move in a negotiation.

OA Motor Assessing provides the technical “counter-punch” required to defeat these assessments. We don’t just provide a quote; we provide a Technical Refutation Report that:

- Documents physical damage missed by desktop adjusters.

- Justifies labour rates through local market reality.

- Cites manufacturer repair standards to mandate OEM parts and procedures.

- Provides an expert witness foundation that is ready for IDR (Internal Dispute Resolution) or court proceedings.

By shifting the debate from “cost” to “technical necessity,” we help legal firms move away from haggling and toward successful quantum recovery.

Are you currently battling a lowball assessment from an insurer-aligned provider?

Contact OA Motor Assessing today for a forensic review of the claim. Let us provide the technical evidence you need to prove the true quantum of your client’s loss.