Is Your Car Worth Less After an Accident? The Truth About Diminished Value in Australia

It’s the question every car owner asks after a collision: “Even if it’s fixed, isn’t it worth less now?”

The short answer is yes. In the automotive industry, this is known as Diminished Value (or legally in Australia as “Inherent Depreciation”). Despite what insurance companies might tell you over the phone, Australian law recognizes that a vehicle with an accident history carries a “stigma” that reduces its market value—regardless of how good the repairs look.

But how do you actually win a claim for this loss? Here is the forensic breakdown of how diminished value works in Australian courts and exactly what you need to prove it.

The “Stigma” is Real: Why Repairs Aren’t Enough

Australian law is built on the principle of Restitutio in Integrum—the right to be put back into the position you were in before the accident.

If you owned a $100,000 car with no accident history, and today you own a $100,000 car that has had $30,000 worth of structural repairs, you are not in the same position. On the second-hand market, a buyer will always choose the “clean” car over the repaired one or demand a significant discount. That “discount” is your financial loss, and it is a claimable economic damage.

The Evidence Checklist: Proving Your Financial Loss

To win a diminished value claim in a venue like NCAT, QCAT, or a Local Court, you must move beyond “estimating” and start “proving.” You need a “Proof of Loss” folder containing the following:

- Pre-Accident Baseline Evidence: Gather your service history logbooks and any photos of the car taken before the accident to prove its pristine condition.

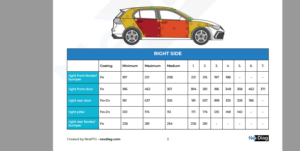

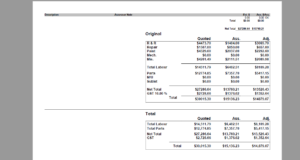

- The Comprehensive Repair File: Provide the original itemized repair quote and the final paid invoice. This proves whether structural components were replaced or if “non-genuine” parts were used—factors that significantly increase the “stigma” loss.

- PPSR / Vehicle History Report: In Australia, significant accidents are often recorded on the Personal Property Securities Register (PPSR). Including this report proves that the accident is now a permanent, public part of the vehicle’s identity that any future buyer will see.

- Market Comparison Data: Collect current listings of identical vehicles (same year, make, model) with no accident history. This establishes the “Clean Market Value” against which your loss is measured.

- The Asset Register (For Commercial Clients): If claiming for a company vehicle, provide the book value from your company’s asset register to demonstrate a tangible “write-down” in asset equity.

- The Forensic Assessment Report: This is the most critical document. An independent car assessor synthesizes all this data into a formal “Expert Witness” document that provides the mathematical justification for the loss.

Why Most Claims Fail (And How to Avoid It)

Many Australians try to claim diminished value by simply telling a tribunal, “I feel my car is worth $10,000 less now.” In court, “feelings” aren’t evidence.

A claim succeeds when it bridges the “Evidence Gap.” You need an independent vehicle assessor whose report meets the technical and evidentiary standards required by legal firms and tribunals. At OA Motor Assessing, our forensic reports are “legal-ready,” providing the professional authority magistrates need to rule in your favor.

The “10% Cap” Myth: Don’t Be Misled

Many owners are told by insurers that diminished value is capped at 10% of the vehicle’s value. This is false. While a 10% cap is used in some parts of the United States (the “17c formula”), it does not exist in Australian law.

In Australia, you are entitled to the actual financial loss you have suffered. For a high-end vehicle or a car with significant structural repairs, the loss of equity can often be much higher than 10%. We don’t use arbitrary percentages; we use forensic market analysis to determine your real loss, ensuring you aren’t leaving money on the table.

Who Should File a Claim?

While any car loses value after a crash, diminished value claims are most successful for:

- Prestige & Luxury Vehicles: Where the “stigma” loss can reach tens of thousands of dollars.

- Commercial Fleets: Where diminished value impacts the company’s balance sheet and asset equity.

- Near-New Cars: Vehicles under 5 years old where the gap between “clean” and “repaired” is at its widest.

The Bottom Line

Insurance companies are experts at cost-mitigation, but they are not the final word on the law. If your vehicle has been involved in a significant accident, you have likely suffered a financial loss that a standard repair doesn’t cover.

Don’t settle for a generic check-over. Get the forensic proof you need to protect your investment and ensure your peace of mind.

Contact OA Motor Assessing today for a professional Diminished Value Assessment and take the first step toward recovering your vehicle’s true market worth.

Disclaimer: This post provides general information and does not constitute legal advice. For specific legal action, we can connect to specialist motor vehicle lawyer in your area.