Is Your Insurance Estimate Too Low? How to Contest a Loss Adjustment and Get What You’re Owed

You’ve waited days for the insurance adjuster’s report, hoping for a fair resolution so you can finally get your car fixed. Then, the email arrives. You open the PDF, look at the bottom line, and your heart sinks.

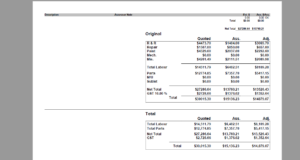

The repair estimate is thousands of dollars lower than the quotes you’ve received from local shops. Or, perhaps they’ve declared your car a “total loss” and offered a payout that wouldn’t even buy a high-mileage version of your car, let alone a replacement in its original condition.

If you feel like you’re being lowballed, you are not alone—and more importantly, you don’t have to accept their first offer. Here is your step-by-step guide to contesting an insurance adjuster’s estimate.

1. Identify Why the Estimate is Low

Before you call your claims officer in a rage, look at the “line items” in the estimate. Insurance companies often save money in three specific areas:

Parts Selection: Are they quoting for “Non-OEM” (generic) or “LKQ” (Like Kind and Quality/Second-hand) parts instead of brand-new original parts?

Labour Rates: Are they using a “contracted” labour rate that no reputable local shop actually charges?

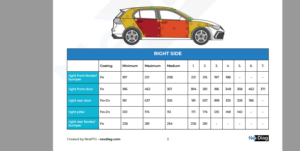

Missing Damage: Did the adjuster only look at the exterior panels and ignore the suspension, sensors, or structural components underneath?

2. Gather Your Counter-Evidence

An insurance company won’t change their mind because you’re unhappy; they will change their mind because you have better data.

Detailed Repair Quotes: Get 2–3 itemised quotes from reputable, high-quality repair shops. Ask them specifically to highlight where they disagree with the insurance adjuster’s assessment.

Proof of Condition: If they are undervaluing your car for a total loss, find 5–10 “Comps” (comparable vehicles). Search local listings for cars of the same make, model, year, and mileage.

Maintenance Records: Show that your car was in “above average” condition prior to the accident to justify a higher valuation.

3. The “Golden Ticket”: The Independent Assessment

The most effective way to contest a loss adjustment is to bring in your own expert. Hiring an independent vehicle damage assessor levels the playing field.

While the insurance adjuster works for the company paying the bill, an independent assessor works for you. They provide a comprehensive, unbiased technical report that documents every cent of damage. In the eyes of an insurance company (and the law), a professional independent report carries significantly more weight than a consumer’s opinion.

4. File a Formal Dispute

Once you have your evidence and your independent report, contact your claims handler and state clearly: “I am formally contesting the loss adjustment dated [Date] for Claim #[Number].”

Attach your independent assessment and your comparable quotes. Demand that they review the new evidence and provide a revised estimate.

5. Know Your Escalation Rights

If the insurance company refuses to budge after you’ve provided professional evidence, you have further options:

Internal Dispute Resolution (IDR): Every insurer has a formal complaints department that is separate from the claims team.

The Ombudsman: If the IDR fails, you can take your case to the Australian Financial Complaints Authority (AFCA) or your local equivalent. These bodies are free for consumers and often look favourably on claimants who have professional, independent assessments to back up their claims.

The Bottom Line

The insurance adjuster’s estimate is an offer, not a final judgment. They are banking on the fact that most people are too busy or too intimidated to fight back. By arming yourself with an independent assessment and the right evidence, you can bridge the gap between a “lowball” offer and a fair payout.

Need a professional report to back up your claim?

Don’t fight the insurance giant alone. Contact our team today for an independent vehicle damage assessment and get the evidence you need to secure a fair settlement.