Is Your Insurance Payout Too Low? The Benefits of an Independent Assessment for Total Loss Vehicles

Why an Independent Vehicle Damage Assessment is Your Best Defense Against Insurance Lowballing

You’ve just been in a car accident. You’re dealing with the shock, the paperwork, and the logistics of getting back on the road. Then, the insurance company sends out their “in-house” adjuster. They’re polite, they take a few photos, and a few days later, they present you with a quote for repairs—or worse, a “total loss” payout figure that seems insultingly low.

If you feel like the numbers don’t add up, your instincts are likely correct.

There is an inherent conflict of interest when the person assessing your damage is employed by the same company that has to pay for it. This is why more and more savvy drivers are turning to an independent vehicle damage assessment to ensure they aren’t being short-changed.

The Conflict of Interest: Why “In-House” Isn’t Always “Fair”

Insurance adjusters have a job to do: minimize the “severity” of the claim. To an insurance company, your car is a liability. Their goal is often to get the vehicle back on the road using the most cost-effective methods possible. This might include:

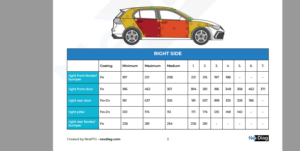

Aftermarket or Second-hand Parts: Instead of Original Equipment Manufacturer (OEM) parts, they may quote for cheaper, generic alternatives.

Overlooking Hidden Damage: Modern cars are packed with sensors, crumple zones, and high-tensile steel. An adjuster looking for a quick “in-and-out” might miss structural issues hidden behind a plastic bumper.

Lowering Labour Rates: They may base their quote on “preferred” repair shops that agree to lower rates, rather than a specialist who will take the time to do the job right.

What is an Independent Vehicle Damage Assessment?

An independent assessment is a comprehensive inspection performed by a qualified third-party assessor who has no financial ties to the insurance company. Their only “skin in the game” is providing an accurate, technical, and honest report of the damage.

When you hire an independent expert, you are paying for an advocate. They look at your car through the lens of safety, quality, and value, not the insurance company’s bottom line.

How it Protects You: Total Loss vs. Fair Repair

Whether your car is repairable or headed for the scrap heap, an independent assessment changes the power dynamic:

1. If the car is being repaired:

The independent assessor ensures the quote covers the true cost of restoration. They check for internal structural damage and ensure the repair method meets manufacturer standards. This report becomes your “source of truth” to challenge an insurance company that is trying to cut corners on your safety.

2. If the car is a “Total Loss” (Written Off):

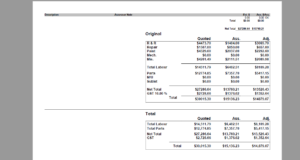

This is where many owners get stung. Insurance companies often use “market value” algorithms that don’t account for your car’s specific condition, low mileage, or recent upgrades. An independent assessor provides a detailed valuation based on the actual local market, ensuring your payout is enough to actually replace your vehicle with one of the same quality.

Peace of Mind is Worth the Investment

Many people hesitate to pay for an independent vehicle damage assessment because they feel they’ve already paid their insurance premiums and shouldn’t have to spend more.

However, think of it as an investment in your safety and your finances. The gap between an insurance company’s “lowball” offer and an independent assessor’s fair valuation can often be thousands of dollars.

Don’t let the person who owes you money be the one who decides how much they owe you. By opting for an independent assessment, you take control of the process, ensuring your car is repaired safely or your loss is compensated fairly.

Why an Independent Vehicle Damage Assessment is Your Best Defense Against Insurance Lowballing

You’ve just been in a car accident. You’re dealing with the shock, the paperwork, and the logistics of getting back on the road. Then, the insurance company sends out their “in-house” adjuster. They’re polite, they take a few photos, and a few days later, they present you with a quote for repairs—or worse, a “total loss” payout figure that seems insultingly low.

If you feel like the numbers don’t add up, your instincts are likely correct.

There is an inherent conflict of interest when the person assessing your damage is employed by the same company that has to pay for it. This is why more and more savvy drivers are turning to an independent vehicle damage assessment to ensure they aren’t being short-changed.

The Conflict of Interest: Why “In-House” Isn’t Always “Fair”

Insurance adjusters have a job to do: minimize the “severity” of the claim. To an insurance company, your car is a liability. Their goal is often to get the vehicle back on the road using the most cost-effective methods possible. This might include:

Aftermarket or Second-hand Parts: Instead of Original Equipment Manufacturer (OEM) parts, they may quote for cheaper, generic alternatives.

Overlooking Hidden Damage: Modern cars are packed with sensors, crumple zones, and high-tensile steel. An adjuster looking for a quick “in-and-out” might miss structural issues hidden behind a plastic bumper.

Lowering Labour Rates: They may base their quote on “preferred” repair shops that agree to lower rates, rather than a specialist who will take the time to do the job right.

What is an Independent Vehicle Damage Assessment?

An independent assessment is a comprehensive inspection performed by a qualified third-party assessor who has no financial ties to the insurance company. Their only “skin in the game” is providing an accurate, technical, and honest report of the damage.

When you hire an independent expert, you are paying for an advocate. They look at your car through the lens of safety, quality, and value, not the insurance company’s bottom line.

How it Protects You: Total Loss vs. Fair Repair

Whether your car is repairable or headed for the scrap heap, an independent assessment changes the power dynamic:

1. If the car is being repaired:

The independent assessor ensures the quote covers the true cost of restoration. They check for internal structural damage and ensure the repair method meets manufacturer standards. This report becomes your “source of truth” to challenge an insurance company that is trying to cut corners on your safety.

2. If the car is a “Total Loss” (Written Off):

This is where many owners get stung. Insurance companies often use “market value” algorithms that don’t account for your car’s specific condition, low mileage, or recent upgrades. An independent assessor provides a detailed valuation based on the actual local market, ensuring your payout is enough to actually replace your vehicle with one of the same quality.

Peace of Mind is Worth the Investment

Many people hesitate to pay for an independent vehicle damage assessment because they feel they’ve already paid their insurance premiums and shouldn’t have to spend more.

However, think of it as an investment in your safety and your finances. The gap between an insurance company’s “lowball” offer and an independent assessor’s fair valuation can often be thousands of dollars.

Don’t let the person who owes you money be the one who decides how much they owe you. By opting for an independent assessment, you take control of the process, ensuring your car is repaired safely or your loss is compensated fairly.

Are you currently disputing a claim or concerned about a low repair quote? Contact a OA Motor Assessing licensed independent assessor today to ensure your vehicle is evaluated with your best interests in mind.