MOTOR ASSESSING

Pre-Accident Valuation

Expertly calculated market values for total loss assessments, ensuring accuracy in every insurance claim. We leverage comprehensive market data and forensic analysis to protect you from undervaluation, ensuring your settlement reflects the genuine pre-accident condition of your vehicle.

Preventing Unfair Write-Offs through Accuracy

Avoid automated underestimations. We provide the independent technical expertise required to calculate precise total loss thresholds based on real-world financial data

Maximize Your Recovery by Defining the True Market Ceiling

Move beyond standard book values. We factor in your vehicle’s unique history and premium features to define a defensible settlement limit that recovers your full equity.

Battle-Tested Evidence for Superior Negotiation Leverage

When an insurer’s offer falls short, our PAV reports serve as your technical backbone. We deliver court-compliant, independent valuations that provide the undeniable evidence needed to challenge underestimations and resolve disputes with confidence.

Our Services

Why OA SERVICES

We don’t work for insurance companies. Our only allegiance is to the technical facts of your vehicle’s condition

In most cases, our professional assessment fees are fully recoverable from the at-fault party’s insurer, meaning you get elite advocacy with no out-of-pocket expense

We understand that momentum is key. Our modern diagnostic tools allow us to provide comprehensive reports faster than industry generalists, moving your claim out of “limbo” and toward a resolution.

100%

95%

100%

Flexible Service Offering

Assessments within 48 hrs

Maximise Savings

FAQ

Frequently Asked Questions

Absolutely. In Australia, an insurer will often write a car off if the repair cost exceeds a specific percentage (usually 70%) of its Market Value. If the insurer uses an undervalued figure for your car, it triggers an unnecessary write-off. We provide an independent, forensic PAV that reflects the actual Australian market. By proving your car is worth more, we can often shift the math to allow for a safe, high-quality repair instead of a total loss

Many Australian insurers rely on generic industry guides like Redbook or Glass’s, which often lag behind the real-world market. Our assessments go beyond these “book values” to factor in the current Australian retail climate, low mileage, and documented service history. We establish a defensible Market Value—essentially your settlement ceiling—to ensure your payout actually covers the cost of a comparable replacement.

Under the General Insurance Code of Practice, you have the right to challenge a valuation. Your first step is Internal Dispute Resolution (IDR), followed by the Australian Financial Complaints Authority (AFCA). A forensic PAV report from OA Motor Assessing serves as your “technical backbone” in these disputes. AFCA heavily weights independent, expert-witness grade evidence over a consumer’s opinion, giving you the leverage needed to win an adjustment.

Insurers often use low valuations to force an economical write-off, avoiding the cost of a proper, safe repair at your workshop’s rates. By providing a higher, more accurate PAV, we “room up” the claim, making the repair financially viable. This allows you to perform repairs to OEM standards without the insurer claiming the car isn’t worth fixing. We provide the data you need to push back against “funny money” estimates and protect the customer’s right to repair.

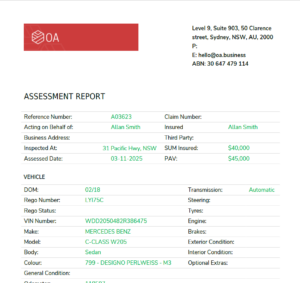

To get your challenge moving, OA Motor Assessing transforms your vehicle data into a defensible technical report. We begin with the Essentials to establish a baseline and use Golden Evidence to prove your car’s superior market equity.

The Essentials (To Get Started)

No “Golden Evidence”? No problem. We only need these basics to begin your forensic assessment and establish a baseline market value:

- Identification: VIN, registration, and exact trim (e.g., ‘LandCruiser Sahara’ vs ‘GXL’).

- Odometer: Current mileage at the time of the accident.

- Photos: photos of the vehicle to identify and use in valuation.

- What OA Does: We cross-reference this data with live Australian retail trends to ensure your vehicle isn’t misidentified or undervalued as a “base model.”

Golden Evidence (The Forensic Advantage)

While insurers often ignore routine service, we use your Golden Evidence to move your car out of the “average” pile and prove it belongs in a superior value bracket.

- Proof of Superiority: We use receipts for major recent investments—like new tyres, timing belts, or brake overhauls—to justify a higher “Excellent” or “Concours” condition rating.

- Asset Equity: We factor in the actual value of aftermarket upgrades (e.g., bull bars, suspension, or custom wheels) that generic insurer algorithms typically ignore.

- Maintenance Verification: We analyse stamped logbooks to provide a technical backbone for valuing your car at the top of the Australian retail range.

The Bottom Line:

The Essentials are all we need to start your file and can be used succesfully if you dont have the details at hand. However, adding Golden Evidence gives us the forensic leverage needed to challenge an insurer’s “average” offer and secure the maximum settlement you are entitled to.

More Insights

Assisting Individual’s and Business Customers for better outcomes.

Need a partner that understands workflow speed is essential!

- Fast Turn-around

- Dedcated Account Manager

- Portal Access