Optimising Quantum Recovery: Why Legal Firms Partner with OA Motor Assessing

For legal clerks and solicitors managing motor vehicle litigation, the difference between a successful settlement and a protracted dispute often hinges on a single factor: the quality of the technical evidence.

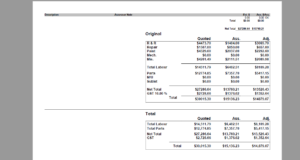

When representing a client in a not-at-fault claim, quantifying the “quantum of loss” is rarely as simple as looking at a repair invoice. To ensure your Statement of Claim is robust and defensible, you need expert data that can withstand the scrutiny of insurers and the courts.

This is where OA Motor Assessing becomes a strategic asset to your firm.

Precision in Quantifying Quantum

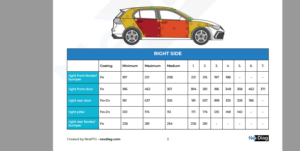

In motor litigation, “reasonable cost of repairs” is a frequently litigated term. Insurance companies often rely on internal assessments that use bulk-discounted labour rates and generic parts to drive down the claim value.

By instructing OA Motor Assessing, your firm receives a comprehensive, independent breakdown of the true cost of restoration. Our reports provide the granular detail required to justify your client’s claim, ensuring that the figures you present in negotiations are backed by industry-leading technical expertise rather than third-party estimates.

Expert Evidence for Total Loss and Diminished Value

Two of the most complex areas of motor law are Total Loss disputes and Diminished Value claims.

Total Loss: When an insurer writes off a vehicle, their “market value” offer often ignores the specific condition, rare options, or recent maintenance of the vehicle. OA Motor Assessing provides detailed valuations based on real-world market data, providing the evidentiary basis for you to argue for a significantly higher payout.

Diminished Value: Even after a perfect repair, a vehicle with a major accident history is worth less than an identical vehicle without one. Quantifying this loss of value is notoriously difficult. Our assessors are specialists in providing the technical reports necessary to pursue diminished value as part of your client’s damages.

Streamlining the Litigation Workflow

We understand that for a busy legal clerk or solicitor, efficiency is paramount. OA Motor Assessing acts as an extension of your team, streamlining the evidence-gathering phase of your file:

Fast Turnaround: We provide rapid inspection and report delivery, preventing bottlenecks in your filing timeline.

Court-Ready Documentation: Our reports are drafted with the requirements of civil procedure in mind—clear, objective, and professionally presented.

Expert Witness Availability: Should a matter proceed to a hearing, our assessors are available to provide expert testimony, offering the professional credibility required to support your client’s position under cross-examination.

The OA Motor Assessing Advantage

In the competitive landscape of motor vehicle law, providing your clients with the best possible outcome requires more than just legal expertise—it requires the best technical support.

OA Motor Assessing removes the guesswork from vehicle damage claims. We provide your firm with the evidence-based certainty needed to challenge lowball insurance offers and secure the full compensation your clients are entitled to.

Does your firm have an upcoming matter requiring a professional damage assessment or valuation?

Partner with OA Motor Assessing today. Contact us to discuss how we can assist with your current caseload and provide the expert reports your litigation strategy demands.